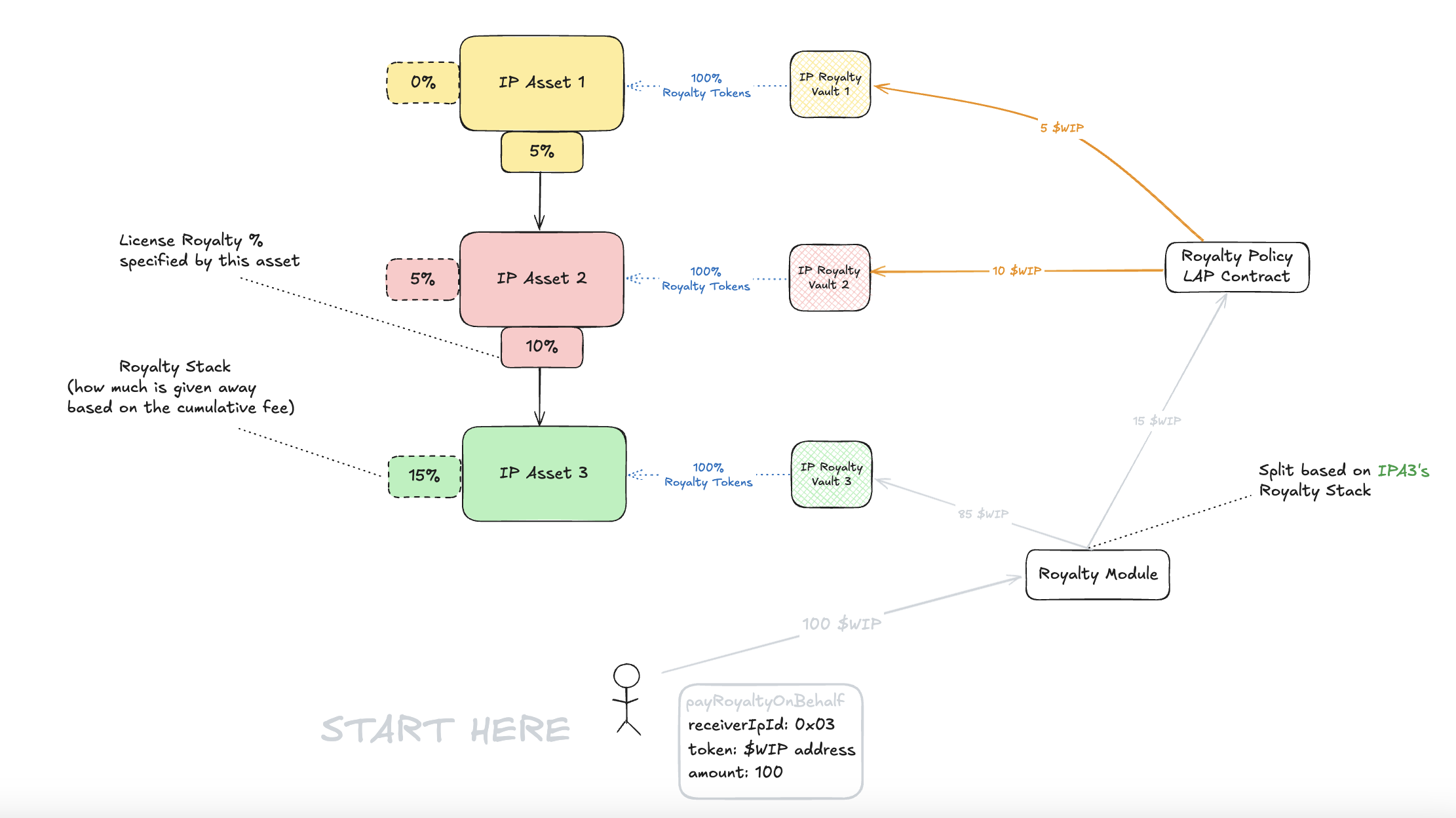

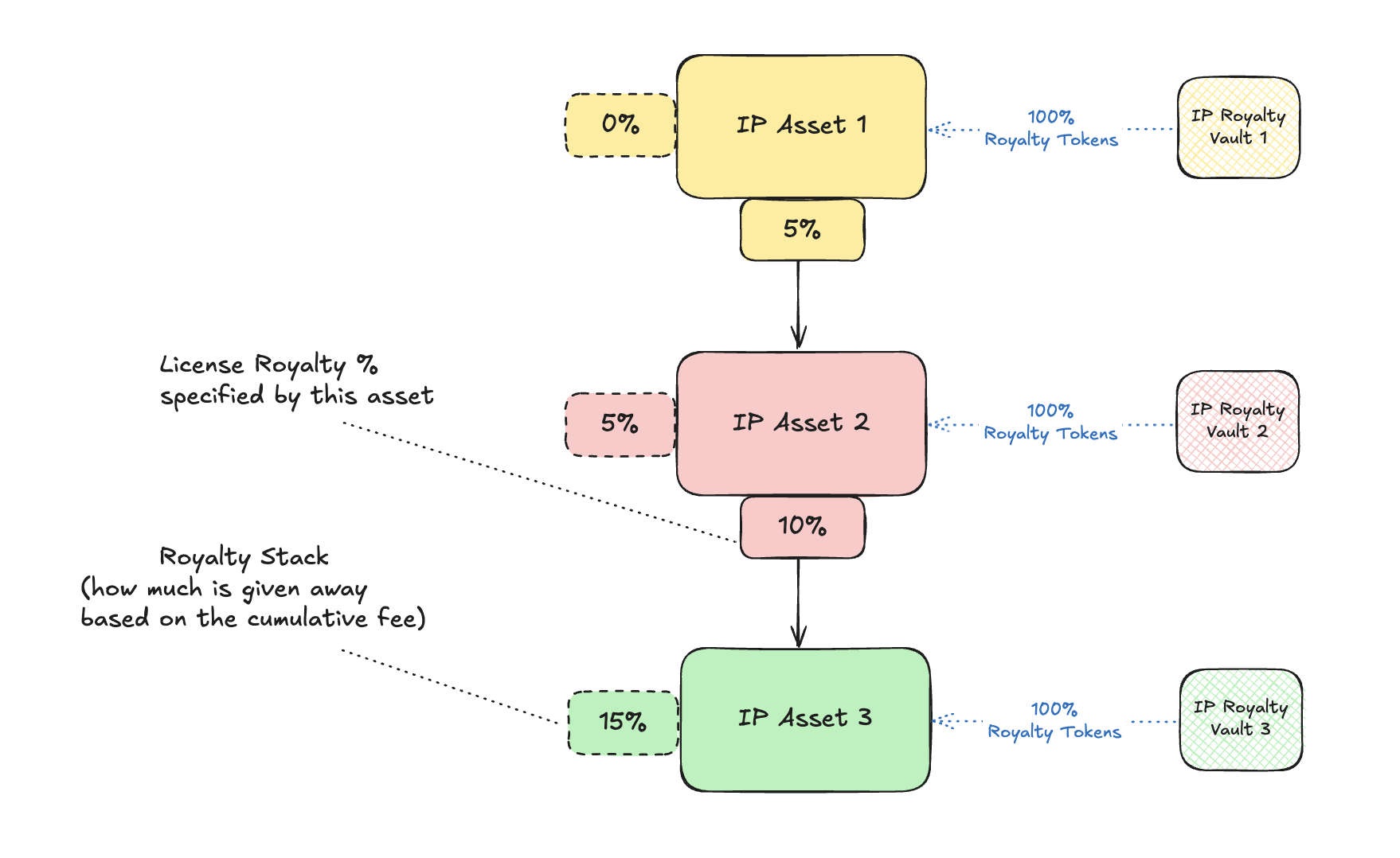

Calculated Royalty Stack

In the image below, IPA 1 and IPA 2 - due to being ancestors of IPA 3 - have a % economic right over revenue made by IPA 3. Key notes to understand the derivative chain below:- License Royalty %: this percentage is selected by the user and it means the percentage that the user wants - according to LAP rules - in return for allowing other users to remix its IPA.

- Royalty Stack: the total revenue % an IPA has to pay to all its ancestors. For LAP, it’s the sum of parents royalty stack + sum of licenses percentages used to connect to each parent

- Royalty Stack IPA 2 = Royalty Stack IPA 1 + License Royalty % between IPAs 1 and 2 = 0% + 5% = 5%

- Royalty Stack IPA 3 = Royalty Stack IPA 2 + License Royalty % between IPAs 2 and 3 = 5% + 10% = 15%

The “License Royalty %” in this diagram corresponds to the same value as the

commercialRevShare on the PIL terms.

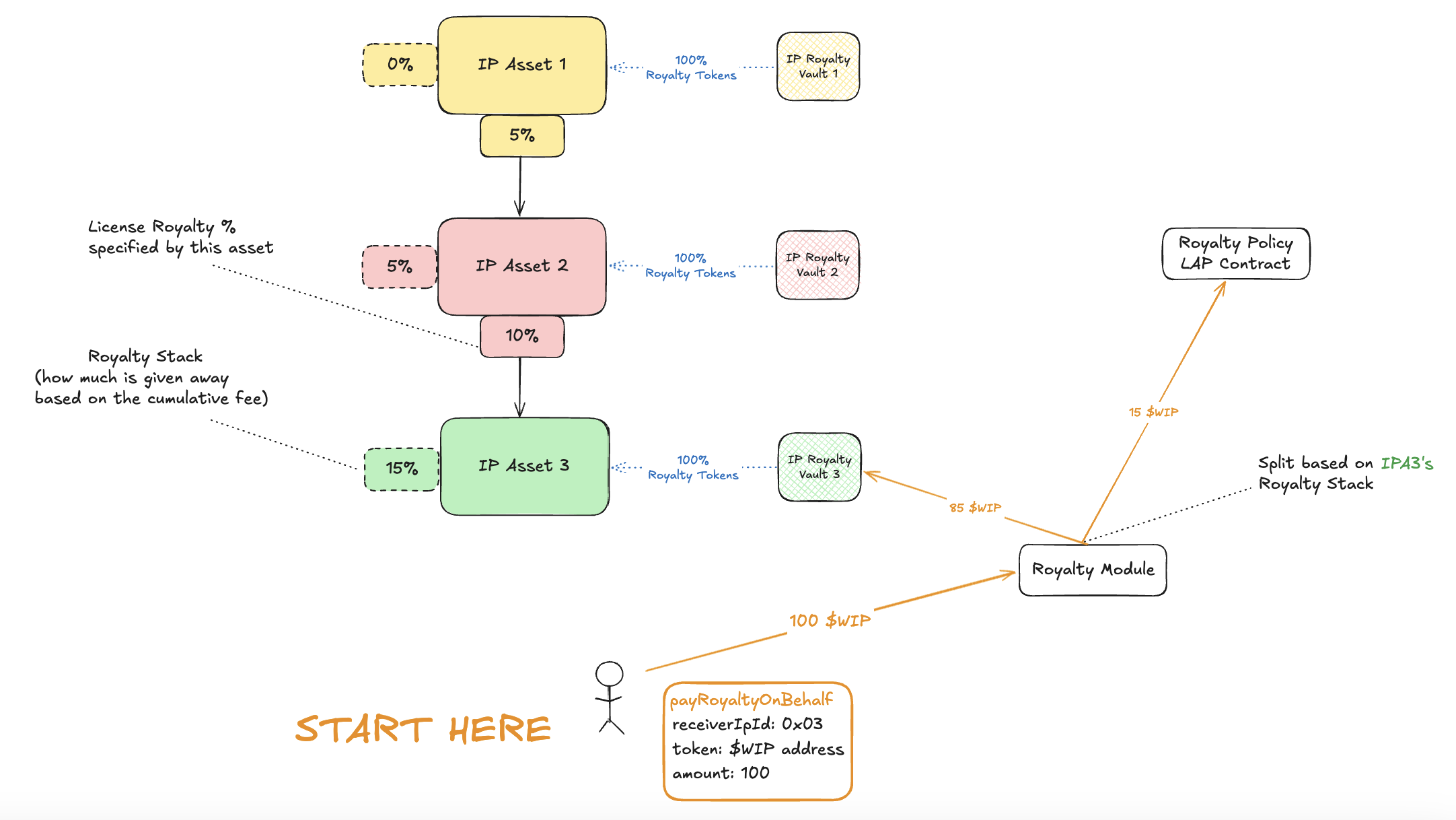

Royalty Module Split

Let’s show an example where a payment is made to IPA 3. In the below diagram, you can see that initial payment is forwarded to the Royalty Module. The Royalty Module then splits the payment based on the Royalty Stack determined by the LAP policy:- 15 $WIP is sent to the LAP policy contract because of the 15% LAP royalty stack

- 85 $WIP is sent to the IPA 3 vault

Royalty Policy LAP Distribution

After this initial payment is complete, IPA 1 and 2 can claim their revenue from the LAP policy contract. The LAP policy contract will then distribute the revenue to the parents based on the negotiatedrevenue share percentages:- IPA2 gets 10% absolute percentage of IPA3’s revenue (10 $WIP)

- IPA1 gets 5% absolute percentage of IPA3’s revenue (5 $WIP)